For such businesses it is advisable to use some other formula for Average Total Assets. This method can produce unreliable results for businesses that experience significant intra-year fluctuations. It is calculated by adding up the assets at the beginning of the period and the assets at the end of the period, then dividing that number by two. "Average Total Assets" is the average of the values of "Total assets" from the company's balance sheet in the beginning and the end of the fiscal period.Calculate the asset turnover ratio using the formula above. "Sales" is the value of "Net Sales" or "Sales" from the company's income statement To calculate the asset turnover ratio, divide the total net sales revenue by the total assets.Companies in the retail industry tend to have a very high turnover ratio due mainly to cutthroat and competitive pricing.Īsset Turnover = Net Sales Revenue / Average Total Assets

Ĭompanies with low profit margins tend to have high asset turnover, while those with high profit margins have low asset turnover. Definition: Asset turnover ratio is the ratio between the value of a companys sales or revenues and the value of its assets. As a financial and activity ratio, and as part of DuPont analysis, asset turnover is a part of company fundamental analysis. Total asset turnover ratios can be used to calculate Return On Equity (ROE) figures as part of DuPont analysis.

#TOTAL ASSETS TURNOVER RATIO FORMULA HOW TO#

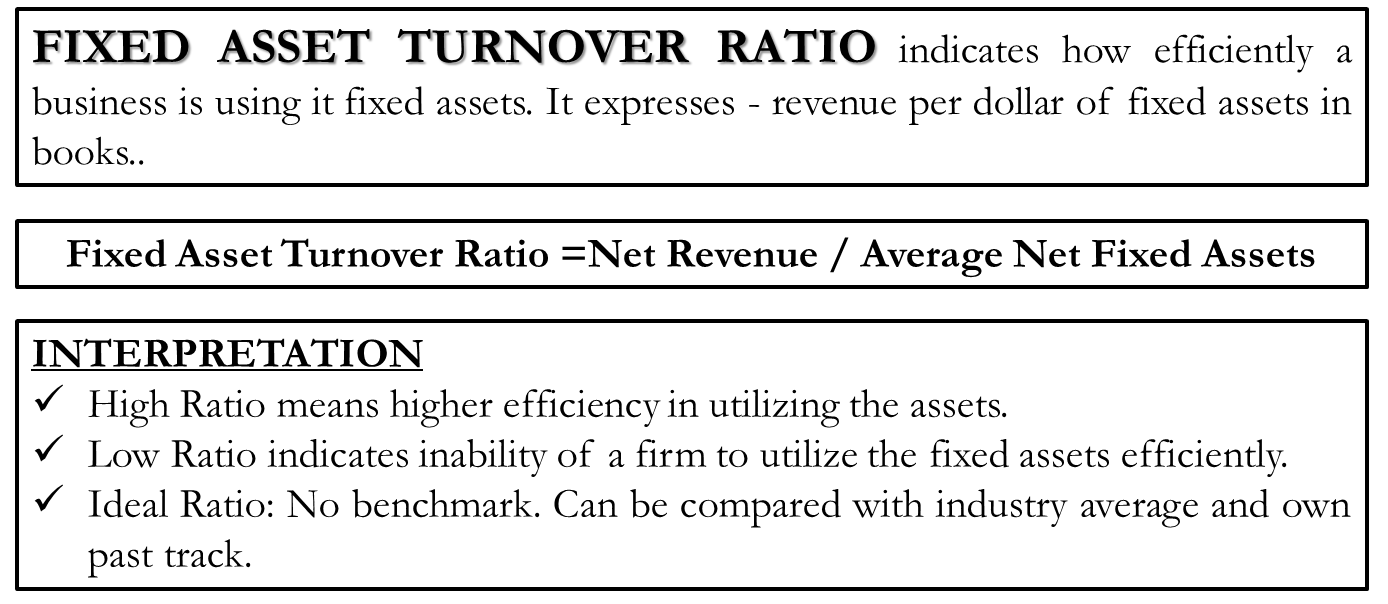

Asset turnover can be further sub-divided into fixed asset turnover, which measures a company's use of its fixed assets to generate revenue, and working capital turnover, which measures a company's use of its current assets minus liabilities to generate revenue. Total Asset Turnover Ratio, Formula and How to Calculate It This ratio indicates what is the level of revenue the business generates using the assets on hand. Source: CFI Financial Analysis Fundamentals Course. As a financial analyst, this is important in day-to-day financial analysis. Asset turnover is considered to be a Profitability Ratio, which is a group of financial ratios that measure how efficiently a company uses assets. The typical profit margin ratio of a company can be different depending on which industry the company is in. The net worth ratio is also known as the return on shareholders' investment.Asset turnover ( ATO), total asset turnover, or asset turns is a financial ratio that measures the efficiency of a company's use of its assets in generating sales revenue or sales income to the company. = 20% Net worth ratio Terms Similar to Net Worth Ratio It now has $4,000,000 of shareholder capital, as well as $6,000,000 of retained earnings. Example of the Net Worth RatioĪBC Company has generated $2,000,000 of after-tax profits in its most recent fiscal year. Thus, an investor relying upon this measurement should also examine company debt levels to see how excessive returns are being generated.

If so, a decline in its business could result in the inability to pay back the debt, which increases the risk of bankruptcy this means that the shareholders may lose their investment in the company. Net after-tax profits ÷ (Shareholder capital + Retained earnings) = Net worth ratioĪn excessively high net worth ratio may indicate that a company is funding its operations with a disproportionate amount of debt and trade payables. Asset turnover equals total sales divided by average total assets. The ratio can be used to determine if there are excessive inventory levels compared to sales. Next, add together the capital contributions made by shareholders, as well as all retained earnings this is the denominator in the formula. The inventory turnover ratio formula is equal to the cost of goods sold divided by total or average inventory to show how many times inventory is turned or sold during a period. The profit figure used should have all financing costs and taxes deducted from it, so that it accurately reflects the profit available to shareholders. To calculate the return on net worth, first compile the net profit generated by the company. The ratio is useful as a measure of how well a company is utilizing the shareholder investment to create returns for them, and can be used for comparison purposes with competitors in the same industry. Thus, the ratio is developed from the perspective of the shareholder, not the company, and is used to analyze investor returns. The net worth ratio states the return that shareholders could receive on their investment in a company, if all of the profit earned were to be passed through directly to them.

0 kommentar(er)

0 kommentar(er)